By A.J. Kaufman, Managing Editor

Since 2013, the Tennessee Department of Education has required a half-semester personal finance course to fulfill graduation requirements. The state says the course is “designed to inform students how individual choices directly influence occupational goals, future earning potential, and long-term financial well-being.”

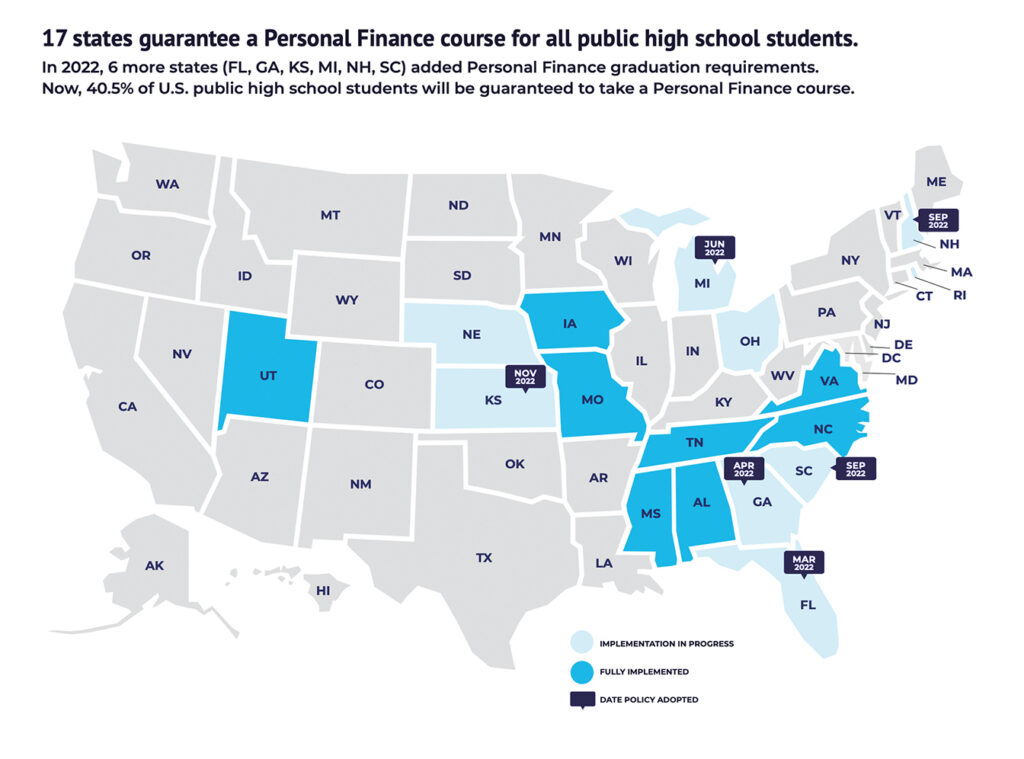

Proudly, the state serves as a model and among the few to enact such a mandate at the high school level. In the past decade since, a wave of financial literacy legislation has been embraced nationwide, as states push to get important personal finance classes integrated into their public schools.

Industry experts note that while financial literacy has long been a national priority, the COVID-19 pandemic sparked the aforementioned state-level legislation to spread nationwide.

Virginia joins Tennessee among the early adopters, too. Along with the Volunteer State and Old Dominion, only Alabama, Mississippi, Missouri, North Carolina and Utah have what Next Gen Personal Finance refers to as the “gold standard” of personal finance education: a standalone half-semester course solely focusing on finance. Some 15 others are in progress.

Currently, less than a quarter of U.S. public high school students were guaranteed to take a personal finance course, although this number is up from under 17% in 2019. The information comes from Next Gen Personal Finance’s 2023 annual report. Based in California, Next Gen is a financial literacy nonprofit with a bold mission that by 2030 every graduating high school student will have taken a one-semester course in personal finance.

Right now, though, the majority of high school students can only take personal finance as an elective or part of another unrelated course, and one report found access gaps also exist along geographic and socio-economic lines.

The latest tracking data from Next Gen — from late November — shows 23 states, including Tennessee, guarantee at least one semester of personal finance before high school graduation. However, Tennessee is one of the few states that requires both economics and personal finance courses, whereas other places may prioritize one over the other.

About half the states required an economics course for graduation last school year, according to an annual survey from the Council for Economic Education.

While Tennessee adopted the high school mandate earlier than most other states, advocates tell us there’s still progress to be had.

“The work is never done,” Tennessee Financial Literacy Commission Director Bill Parker told CNBC last month. “When they get to that high school course, ideally, they’re in a position to hit the ground running with some more advanced concepts that they can apply to their own lives.”

Created by the General Assembly under the Financial Literacy Program Act of 2010, the commission aims to incorporate personal finance into schools “as early as possible.”

The group has outlined priorities in its strategic plan through fiscal year 2025-26, which includes state-level advocacy for expanded financial literacy programming.

Why again?

Numerous studies have revealed the benefits of teaching children financial literacy at a young age and a strong connection between financial literacy and financial well-being.

Students who are required to take personal finance courses are often more likely to tap lower cost loans or grants if and when they attend college. According to a study from National Endowment for Financial Education, they are also less likely to utilize high-interest credit cards.

“No matter what walk of life a person pursues — farmer or pharmacist, ballplayer or businessman — a common denominator throughout life will be the person’s understanding of financial matters and making smart money decisions,” Powell Valley National Bank President and CEO Leton Harding told the Business Journal. “Bankers and others in Tennessee and Virginia have been committed for decades to improving financial and economic education. Smarter consumers make for better customers.”

It’s a win-win endeavor overall, and the states encompassing the Tri-Cities region lead the way.