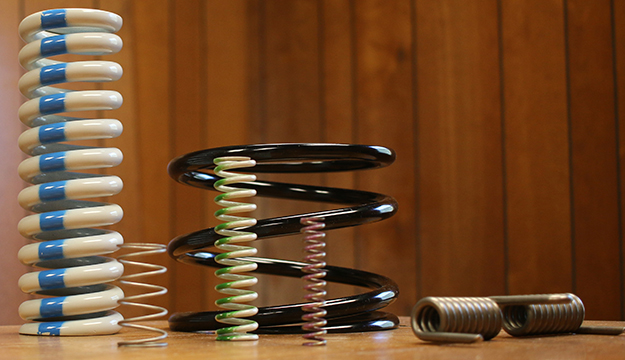

FWG’s man in the states, Ryan Lilly, with some of the German company’s products.

Photo by Jeff Keeling

By Jeff Keeling

It took FWG Special Springs roughly a quarter century to make its first foray into North America. Since the Grevenbroich, Germany manufacturer established a tiny beachhead in Johnson City two years ago, things have moved much more quickly – so much so that the company has bought a building and is preparing to manufacture stateside, ahead of schedule.

In mid-2013, company founder Manfred Albrecht visited East Tennessee State University’s Innovation Lab. Albrecht had long dreamed of marketing FWG’s springs – used primarily in valves for waterworks, oil and gas rigs, the nuclear industry and other types of process management – in the western hemisphere. In 2011, Albrecht connected with Rainer Heumann, who at the time was working for the state of Tennessee trying to recruit European businesses. Heumann introduced him to Alan Bridwell, director of the Northeast Tennessee Valley Regional Industrial Development Association, who quickly convinced Albrecht he should check out the Tri-Cities.

Those connections led Albrecht and other company leaders to the I-Lab, just as Director Dr. Audrey Depelteau was working toward certification in the international “soft landings” program. With the help of Dr. Jon Smith, director of ETSU’s Bureau of Business and Economic Research – Smith himself had a longstanding academic connection with a German university – Depelteau worked to steer FWG execs to the right folks for everything from language translation and payroll services to legal incorporation and employee recruitment.

Fast forward two years, and Ryan Lilly, a 20-something UT graduate with degrees in German and world business, is FWG’s man on the ground in Johnson City. Lilly showed off FWG’s still-developing digs in late October, where boxes of product await shipping to Emerson Process Management in Mexico. Emerson is the parent company for the world’s largest array of valve companies, and those valve companies need plenty of springs for their products.

“This was No. 1 on my CEO’s list of customers to get,” Lilly said of the Emerson Deal. The Science Hill High School graduate, who also took his masters in transitional economics while in Germany, said despite its decades of German history, FWG was essentially like a startup company in the states. The company had a small list of customers from European operations over the past 35 years and targeted some of those, but beyond that the work involved a lot of cold calls.

The yield includes a pair of three-year contracts – including the Emerson deal – worth about a half million dollars annually. Along with other prospects, it’s enough to have spurred FWG to buy a building and move toward a small level of production.

The company’s in 18,000 square feet on Rolling Hills Drive at the foot of Buffalo Mountain and is using just half of it at this point. Over the next few months, a plant manager and engineering folks from Germany will arrive to set up a couple of small automatic spring making machines.

“It really takes just one or two people to man those, but when we start getting our cold-coiling machines over here, we’ll bump employment up to six, 10, 15,” Lilly said.

A big reason FWG is investing in stateside production is the cost of shipping that occurs not once, but in many cases twice, in order to deliver products to North and South American customers. A number of the metals FWG purchases for its European manufacturing actually come from Pennsylvania, including the alloys inconel family and hastelloy, which have ultra-high heat tolerances and corrosion resistance.

“They were looking for long-term contracts like the ones we have now that could justify opening up manufacturing operations here, so we can start buying cheaper raw materials and cut out the extra shipping time and cost,” Lilly said.

The operation seems small, but Lilly said FWG makes most of its springs to order for customers. The most important criteria are the spring rate (strength), length and width. From there, the buyers typically provide FWG, with its expertise, some leeway to deliver high performance at a competitive cost.

From here, Lilly said, it’s about continuing to gain exposure and market share in North and South America. But with raw materials more economically available here, it’s not outside the realm of possibility the company could even manufacture some product for the European and Asian markets here, Lilly said.

“(Albrecht) is definitely looking forward to buying those materials here and being able to manufacture here,” Lilly said. “Our timetable depends on how fast we get new contracts (another big advance was a December 2014 long-term deal with Zurn of Paso Robles, Calif.). We need a little bit of exposure. We need to say, ‘we’re here now, we have a warehouse where we can keep your springs and deliver them to you on a two-day notice.’”