By Jeff Keeling

Despite strong growth in premium revenues, Mountain States Health Alliance’s foray into offering its own Medicare advantage insurance plan, CrestPoint Health, was far from profitable, MSHA Senior Vice President Tony Keck said after CrestPoint’s pending wind-down was announced.

“We were losing money, which is not unusual for a startup plan in insurance in any business,” Keck said April 15. “That’s why, for instance, the federal government was giving the co-ops $100 million to start up an insurance plan – but you can see where a lot of those co-ops have ended up going bankrupt.”

MSHA decision to cease offering CrestPoint will affect more than 6,000 Medicare advantage customers. Those customers, who have received letters from MSHA, have until June 1 to find another Medicare advantage plan.

CrestPoint also serves as the third party administrator for more than 13,000 MSHA employees and dependents (MSHA is self-insured). Those services will transition to Blue Cross Blue Shield effective July 1. Around 50 people work at jobs related to CrestPoint, though all but about 10 of those have other duties involving different MSHA service lines, Keck said.

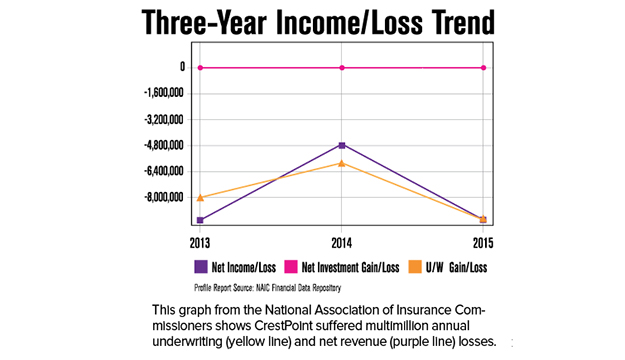

MSHA unveiled CrestPoint about four years ago, at a time when the health system’s previous administration saw potential advantages to entering the insurance market. But state filings show CrestPoint lost around $8 million in each of the years 2013 and 2015, and about $4.8 million in 2014.

The losses came despite premium revenues rising from about $1 million in the fiscal year ending June 30, 2013, to $10 million the next fiscal year and more than $30 million in the most recent fiscal year. Keck said assessments prior to the implementation of the Affordable Care Act (ACA) that “MA” product lines could become profitable for hospital systems, “relied on a whole set of assumptions that I think eventually didn’t play out.”

Keck said a health system comparable to MSHA recently vetted starting an MA plan and reckoned, “they were going to need half a million (covered) lives and it would take two to three years to generate a profit.”

The disruption to current customers and impact on CrestPoint employees were weighed against not just the bottom line numbers, Keck said, but with an eye toward overall mission.

“We have other lines of business that lose money, such as a number of our rural hospitals,” said Keck, whose duties include overseeing CrestPoint. “So the decision criteria isn’t purely, ‘are we losing money on this service line?” it’s ‘what role do we have in the market?’ It’s pretty clear that nobody else in the market is going to be able to run rural hospitals like us, for example, but there’s a number of very good organizations that run MA plans.”

Merger-related?

Asked whether MSHA’s leadership considered, in light of its pending request for approval to merge with Wellmont Health System, the insurance industry’s likely preference that hospital systems not compete in the insurance segment, Keck said he couldn’t speculate – at least not on how Virginia and Tennessee would view the issue. He said the analysis of CrestPoint and decision to end it came independent of the merger considerations.

“There’s a couple of insurance companies that have voiced concern – Anthem being one of them – that the merging entities also had an insurance product,” Keck said. “But the reason we vetted this when I came on board was related to, ‘can this be a viable business for Mountain States?’”

CEO Alan Levine wrote to MSHA employees April 13 that “the stakeholders in our region” care most about MSHA providing well capitalized hospitals; investing in physician recruitment and retention; investing in technology that improves care; and “ensuring access to services where we alone add value.

“Where other well-capitalized companies are already in the insurance market, it is therefore difficult to justify the ongoing major investment required to continue in that space…” the letter continued.

The wind-down will last several months. Employees whose jobs are being eliminated will have the option of an additional three months of full salary and benefits if they seek other options within MSHA through its career resource center.

Levine’s April 13 letter also referenced a desire to build “greater alignment with physicians” as reimbursement models move toward paying for value and not just volume. Some independent physicians’ groups also have expressed concern about potential merger effects.

“Alan has spent a lot of time reaching out to folks, emphasizing two things,” Keck said. “One, we need each other; and two, you’re great at what you do and we’re great at what we do, so let’s work together. Our interest is not in owning everything and running everything.”