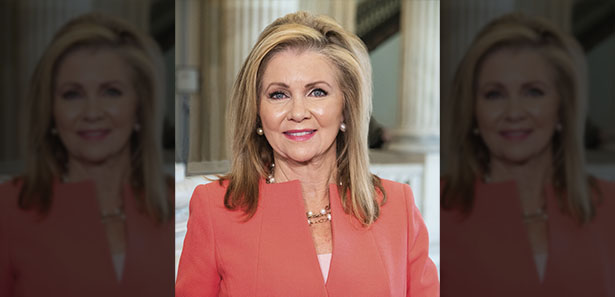

Q&A: Senator Marsha Blackburn

Much has been made of the United States’ debt to China, currently around $1.08 trillion. In the few decades since China went from being an entirely Communist power to utilizing a mix of Communism and Capitalism, that nation’s economy has grown exponentially. Tennessee Senator Marsha Blackburn has made China policy a significant part of her work since taking office upon the retirement of Bob Corker. She released a white paper on China several weeks ago in which she warned that the COVID Crisis could “provide the nexus to shape a new world order.*” To stave off the tide of Chinese economic inroads, and focusing particularly on the United States, Blackburn and Arizona Senator Martha McSally recently introduced a non-binding resolution demanding China pay U.S. Bondholders more than $1.6 billion in debt that goes back as far as 1912. The Business Journal spoke with Blackburn August 20.

The Business Journal: Thank you for speaking with us today, Senator. Tell us about the genesis of the resolution you’ve co-sponsored with Senator McSally regarding some very old debt owed by China.

Senator Marsha Blackburn: Well, this is a debt that is held by U.S. citizens, and you’re right, it goes back decades. The United Kingdom resolved this issue when (Margaret) Thatcher was the prime minister, but this has never been resolved for U.S. citizens. So, as we began hearing from people about what we wanted to do about China, from repatriating manufacturing to having China waive their debt, the association which has dealt with this, which is led by a Tennessee resident, brought this forward and said, ‘You know, we were never able to get this issue resolved, and we would like to elevate this as we talk about China being required to make U.S. companies and citizens whole.’

You know, we have the Stop COVID Act, which is a piece of legislation that (Senators) McSally and Hawley and Cotton and several others have worked on, which (if passed, would give) U.S. citizens a day in court for loss of life and/or livelihood. They (might be able, if the bill becomes law) to take the Chinese Communist Party to court. In this legislation, what we would do is remove the foreign state immunity protection. This is what we did for 9/11 survivor families. It’s what we did for the Beirut bombing survivor families so they can seek compensation from that government. So, getting back to all of these debts, the bondholders came forward and said, ‘We would to see if there is an avenue for us to hold China to account to fulfill their obligation on these bonds, which they have not done.’

BJ: In talking with companies in our neck of the woods that do business internationally, they were generally pleased when the trade agreement with China was signed after a couple of years of difficult negotiations and hard work. But they only had a few weeks of relative stability before COVID hit and we were thrown into another round of what is essentially open economic conflict with China. It’s my understanding that China was supposed to spend $200 billion with us this year and next year as part of the trade deal. While we’ve had some success in agriculture, the Chinese are not coming close to honoring their agreements in other areas. Is that an accurate assessment?

MB: My understanding is that that is a fairly accurate statement. There has been aggressive trade in the ag sector. China, of course, is facing restrictions from some of our U.S. companies when it comes to semiconductor chips, and just like my SAM-C bill (The Securing America’s Medicine Cabinet Act – S. 3432) would repatriate pharmaceutical manufacturing to the U.S. – active pharmaceutical ingredients, then what you would see in other sectors is a push to repatriate some of that manufacturing. There are some companies who have been leery of doing business with China, and they again expressed concerns if there is a secondary source they can use that is not China-based because of lack of trust with China holding their intellectual property, honoring those agreements, or concerns about actually getting things shipped out of the country. So, there is some hesitation there. I don’t know the exact figures, but this does get updated by (the U.S. Department of) Commerce every month. (Ed. note: after the interview the senator’s office forwarded the following figures from the Commerce Department – see “Promises Made, Promises Unkept” below.)

BJ: One of the problems, according to businesspeople we have spoken with, is that there seems to be a fundamental cultural problem going back to how China views the West, going back to the Boxer Rebellion and even the Opium Wars. We hear there seems to be no moral compunction whatsoever about doing things to western companies like ignoring intellectual property rights and flat out stealing, frankly.

MB: Yeah.

BJ: From a practical perspective though, the U.S. has to have China as a trading partner in the world economy; the two largest economic powers in the world have to do some business together. So, how do we protect American businesses from something that is essentially a culturally ingrained enmity from our would-be trading partner?

MB: I think you are so spot-on on this. You see, they feel like, how they look at who owns your thoughts and your ideas. They feel like if you print something, it is then owned by the public because you have thereby shared it. We don’t believe that if something is printed then you have no ownership. We believe that you are entitled to benefit from that concept that you created or the widget that you designed or the book that you have written or the song that you have written. So, you are exactly right. China uses a completely different way.

I heard one of the best statements the other day. I don’t know if you’ve followed the case of Jimmy Lai, who is a journalist and works out of Hong Kong. Under the new China security law, they arrested him at his office. He gave an interview to Maria Bartiromo last weekend, and he said, ‘You know, the world wants China to assimilate to the world and do business like the rest of the world, the community of nations does business, has interactions, and participates in global organizations. China isn’t interested in that. China is interested in domination. They want the rest of the world to submit to them.’

So, that is a fundamental difference. Now, I will tell you, I have been very pleased with our allies and how they have stood up and pushed back on China. I think that is incredibly helpful. It is something that is going to stand us in good stead as we move forward and try to deal with China because at this point where we are, we have to realize that China looks at the 21st century as the China century. They think they are entitled to it. Xi Jinping (general secretary of the Chinese Communist Party) has set himself up as the autocrat for life. He is going to be president for life. He is more like Mao and is looking at Maoist-type policy. They are trying to expand into the China Sea. They are pushing back on Hong Kong, changing their agreement there. They are pushing on Taiwan. They are pushing into countries all across the globe through their debt diplomacy options. In Djibouti (Africa), they are giving Djibouti technology in exchange for their port, which was to be commercialized, but now they have put a military base there. So, China is incredibly aggressive. It is going to require the community of nations to push back on China and say, ‘No, you really can’t do things like this. This is not the way nations act toward one another. There is a protocol for how you conduct yourself within the community of nations.

BJ: If we look at reshoring our manufacturing that has gone to China, obviously the fact that China has stolen intellectual property from businesses that went there for cheap labor over the last 20+ years has made it clear that there is good reason to pull back from that kind of business relationship. But, when we reshore manufacturing, we are going to see increases in costs as we restructure our own economy, as we build new plants and create new jobs. That’s going to take an investment of time and capital – there are going to be costs associated with it. Do you think it will be a difficult sell to American consumers to say, ‘Look, your drugs will probably cost more because they’re going to be produced here,’ or do you think the American people will see the national security need and be willing to make those sacrifices?

MB: You know what is so interesting to me about all of this? Having worked on the issue of China going back into the mid-1990s when we were dealing with issues of piracy in the entertainment industry, and then of course we saw this expand into handbags and scarves and things that would be knocked off and sold on the street. Then you started to see our lumber industry get hit with furniture that was made by inexpensive labor in China but then did not hold up.

I talked to a lady the other day, and I think this pretty much sums up where a lot of people are. I know this is a little bit simplistic, but I think it says, ‘This is where people are traveling.’ She said, ‘Marsha, I’ve got to tell you what I did. I had to buy some new linens.’ They had a child who was going off to college. ‘So,’ she said, ‘I got online and started looking for the things we needed.’

She said, ‘I would see different prices popping up,’ and she would read about one and it would hit her that it was made in China. So, she entered into her search engine what she was looking for, but made in the USA. She said, ‘I tell you what, I am willing to pay an extra $5 for a set of sheets to know that I am not sending money to the Chinese Communist Party.’

This is a lady who is not politically active, but she is smart. She’s astute. She pays attention to events and she had never thought about China and China’s government being one and the same with the Chinese Community Party. Through all of this information about COVID, and then hearing people say, ‘Well, you know, 10 years ago I lost my job to China,’ and beginning to hear some of this information, she began to put it all together.

So, I will tell you, just as that lady is a consumer who’s putting in her search engine that she’s willing to pay, or that Tennessean who had that cardiovascular pharmaceutical that was recalled because it was made in China and it was contaminated, or so many other different cases of companies that had their intellectual property stolen by the person doing the manufacturing in China and now that company is out of business and now 53 U.S. jobs, Tennessee jobs, are lost. That is the type of thing that has us saying, ‘Surely there is a template for this coming back.’

That’s why the SAM-C bill, the pharmaceutical bill is so encouraging – the acceptance of it. The president has done much of it by executive order because you incentivize the return of these businesses. You put in place partnerships that institutions of higher learning can apply for advanced manufacturing grants in order to complete the education of students who are going to work in these industries. I think people are willing to pay another dime on the dollar to know they’re not sending money to the Chinese Communist Party.

Promises made, promises unkept

• Through June 2020, China’s year-to-date total imports of covered products from the United States were $40.2 billion, compared with a prorated year-to-date target of $86.3 billion.

• For covered agricultural products, China committed to an additional $12.5 billion of purchases in 2020 above 2017 levels, implying an annual target of $36.6 billion (Chinese imports, panel b) and $33.4 billion (US exports, panel c). Through the first six months of 2020, China’s purchases were thus only at 39 percent (US exports) or 48 percent (Chinese imports) of their year-to-date targets.

• For covered manufactured products, China committed to an additional $32.9 billion of purchases in 2020 above 2017 levels, implying an annual target of $110.8 billion (Chinese imports) and $83.1 billion (US exports). Through the first six months of 2020, China’s purchases were thus only at 57 percent (US exports) or 55 percent (Chinese imports) of their year-to-date targets.