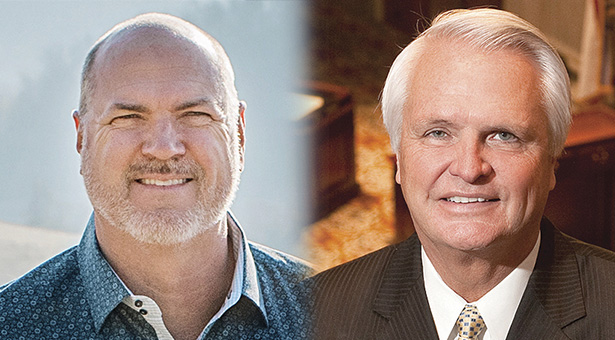

Steve Johnson and Ron Ramsey (Right)

Former Tennessee Lt. Governor Ron Ramsey will be back in Nashville this legislative term, lobbying for a regional real estate developer. When Ramsey was Lt. Governor of Tennessee in 2011, he helped push through the Border Region Tourism Development District Act (public chapter 420) that created the tax breaks that incentivized retailers to come to the Pinnacle development on the Virginia state line.

Last year, though Public Chapter 420 had sunset, the Tennessee General Assembly put a similar incentive package in place for a plot of land off the Boones Creek exchange with I-26 in Washington County. Today, Ramsey, retired from public service and under contract to Johnson, is working to ensure Pinnacle retailers don’t jump ship to the proposed Washington County development.

“Ron Ramsey’s specific mission is that the 2019 law ought to be amended,” Johnson says. “It should say that if that site can attract any new business and/or industry, it should include neither a) any business that has already taken advantage of the Border Region Tourism Development District Act, and/or currently exists in either the Pinnacle or Kingsport, and b) is an already existing business on Roan Street or State of Franklin. If it can attract new businesses that don’t fit into those categories, then by all means, let it be all can be. But if all that you’re going to do is rob existing retail from the Pinnacle, Kingsport or Johnson City, you’re doing nobody any good.”

Incentive packages for counties near borders with other states are designed to bring out-of-state customers into Tennessee, which exists on a sales-tax based revenue model. Since Tennessee does not collect income taxes and has kept its tax rates low on other taxes, sales tax collections are vitally important to the state government. So, all sales taxes collected from out-of-state citizens can be directed toward incentivizing retailers without cutting state services.

“Chapter 420 enabled municipalities that qualified and were on the Tennessee state border to compete against a neighboring state,” Johnson said, noting that before Chapter 420, Tennessee’s high sales tax rate was often blamed for retail customers leaving Tennessee to make large purchases. “We can’t compete on a sales tax standpoint with Virginia, North Carolina, and Georgia, Alabama and other states. So, it was a field leveler, if you will, to be able to compete for our fair share of retail, dining and entertainment around the perimeter of the state of Tennessee.”

Because Washington County is not a border county, Johnson says, a development there is more likely to pull dollars from surrounding Tennessee counties, and even from other developments in Washington County, than to pull from other states.

“Having put Chapter 420 in place to level the playing field for border municipalities,” Johnson told The Business Journal, “it makes no sense for the state now to empower a local municipality to undo what they put in place to do.”