In introducing a new department this month, we decided to hone in on some data that is certain to be in the sights of at least three other entities – the finalists for alignment in Wellmont Health System’s strategic options process. Wellmont leaders have said recently they hope to announce a decision about an alignment by sometime late this year.

The system provides quarterly and annual financial information and operating data for its bondholders, and posted unaudited data and narrative (management discussion and analysis) for the fourth quarter of fiscal 2014 on Oct. 27. This document also provided a full-year snapshot for the fiscal year ended June 30. We compared numbers to fiscal 2013, and also looked at the two previous fiscal years. The figures revealed a continuation of downward trends in acute care hospital discharges, and a somewhat slower decline in “patients in bed” due to continued increases in “observation patients.”

As is common across the industry, Wellmont has seen declines in acute care admissions in recent years.

On the financial side, Wellmont experienced a fairly sharp decline in operating earnings. The system’s days cash on hand improved, and its long-term debt to capitalization ratio was nearly unchanged. The system did see a significant drop in its debt service coverage ratio to a level notably lower than the average of the three preceding years.

A few specifics

On the patient volume side, trends ended the year largely headed in the same direction they had been the previous several years. The better-reimbursing hospital “acute discharges” totaled 34,365, a decline of 5.7 percent from fiscal 2013’s 36,431. That follows a decline in fiscal 2013 of 9.2 percent from fiscal 2012. And fiscal 2012’s numbers were 4.6 percent lower than 2011’s (see chart 1). From 2011 through the still unaudited 2014 year, acute discharges fell a total of 18.3 percent. In its narrative, Wellmont attributed the declines mostly “to reduced utilization from the implementation of the accountable care organizations and high deductible plans in our area.” It also attributed a 2.2 percent decrease in surgeries, which came not from inpatient procedures but from its ambulatory centers, “to the increase in high deductible plans in our area.” (Note: Wellmont closed Lee Regional Medical Center at the end of the first quarter of fiscal 2014.)

Those numbers have been partially offset by a rise in “observation patients.” These patients are admitted to the hospital but held under a different status – and one that carries with it significantly lower reimbursements, as reported in a February Business Journal article. That number trended up again last fiscal year, rising to an unaudited 14,205 from 13,013 in fiscal 2013 for a 9.2 percent jump. In fiscal 2011 there were 10,841 such patients, so that number rose 31 percent from 2011 through 2014.

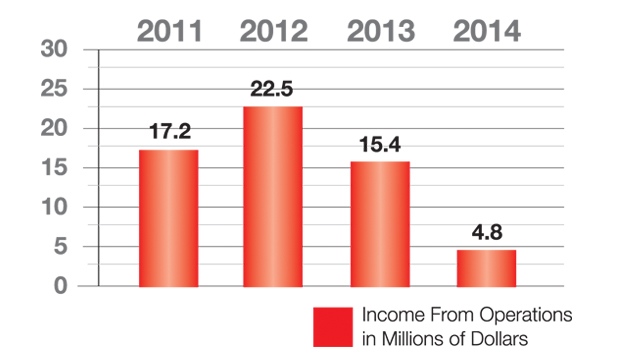

Financially, Wellmont saw its income from operations dip below $15 million for the first time since 2009 and to its lowest level since 2008 (see chart 2). Operationally, the system made $4,844,000 on total revenue of $772.7 million in the 2014 fiscal year. Those unaudited figures compare to operating income of $15,412,000 in fiscal 2013 on revenues of $780.1 million. For the fourth quarter, the system posted an operating loss of $1,334,000. Factoring in nonoperating gains or losses, Wellmont saw its “revenues and gains in excess of expenses and losses attributable to Wellmont” come in at $6,332,000 for fiscal 2014, compared to $31,372,000 in fiscal 2013. The percentage declines for operating income and revenues and gains from 2013 were 69 percent and 80 percent, respectively.

While Wellmont’s days cash on hand improved slightly, its debt service coverage ratio – the ratio of its total income available for debt service to its maximum annual debt service – declined 20 percent, from 2.56 in fiscal 2013 to 2.05 in fiscal 2014. The numbers for 2011 and 2012 were 2.70 and 3.07, respectively.

Miscellany

- Wellmont’s fall 2013 acquisition of Wexford House, a Kingsport skilled nursing facility, was listed at $13.5 million, and its revenues were noted as contributing positively to overall net revenues.

- Wellmont sold its 60 percent interest in Greeneville’s Takoma Regional Hospital and received $1l.7 million for that. That joint venture was paired with “lower performance” of the managed care and home care joint ventures as contributing to $1.9 million in decreased net revenue.

- “Meaningful use” payments from the government for electronic health record implementation (in Wellmont’s case, the Epic system) are tapering down, and dropped to $7.2 million in FY 2014 from $12.7 million the year before.

- Wellmont ended the fiscal year with $550.8 million in net assets and $490.4 million in long-term debt, compared to $514.9 million in net assets and $475.9 million in debt at the end of FY 2013.